Unknown facts about Indian Insurance | Why one should have Health Insurance | INFOCOTE

A middle class man:

A middle-class man will constantly make an effort to avoid paying for medical expenses in order to prevent going into poverty. Every administration since the country’s independence has failed miserably in this particular area. In order to determine whether the invoices created by these institutions are legitimate or have undergone some sort of manipulation, the bills of patients who visited the renowned hospitals in Delhi NCR were gathered and examined.

Life of a common man

There is a man who earns all the money and has parents, a wife, kids, and siblings. Therefore, he cannot live such a long life with the assumption that no one will experience harm. Do celebrities like Elon Musk and Bill Gates have health insurance? Do they require medical insurance? And when the government failed, it also did what any unsuccessful person would do, which is to pass the buck to other people. Ancient Chinese and Babylonian traders discovered a means to lower their risk that had never been employed before, and that is the principle that still governs us today.

Benefits of removing Risks

It was determined by the group as a whole that we will pool some funds and, in the event that anyone loses, we will distribute our losses equally. This has the benefit of removing all risk for less money for everyone. We still use this idea today; it’s called insurance. People pay money to be risk-free; if this money is collected for hazards associated with cars, it is known as car insurance. We refer to it as property insurance if it is collected for hazards involving properties. Similar to that, if it is collected to cover health risks, it is referred to as health insurance.

Because it affects so many people and affects society as a whole in the modern world. Therefore, you cannot simply give someone money and trust them to handle it. Consequently, a reputable organisation that complies with government standards joins the procedure. which we refer to as an insurance firm. By placing their trust in this business, everyone is able to collect money, which is referred to as a Premium. Insurance may seem like a rather dull subject, but it is a highly vital one. In fact, such subjects ought to be covered in school textbooks, but they aren’t. Because of this, the small child only knows its name and not much else about it.

Responsibilities

But as soon as you start to accept responsibility for yourself, you realise how important it is. Additionally, if you are a young person whose family depends on you, you should be aware of more information about it. As you can see, the government bears full responsibility for providing healthcare in every nation. that it must offer affordable, high-quality healthcare to all citizens. India after independence is also pursuing it. But regrettably, every government since independence up until the present has failed miserably in every aspect with regard to this particular issue. Additionally, the government did what any failing person would do to shift blame on others when it failed. The government allowed many private hospitals access.

In India- Hospitals

In India, private hospitals were also developed. However, it is clear that the private hospitals were not started for charitable purposes; rather, they were created to turn a profit. The price of healthcare soared as a result. hospitals with many specialties and super specialties, typically costing in the millions. But because it provided them more options, it also helped the wealthy. If you use Covid as an example, more patients and fewer hospitals existed at that period. The people and the government were both under pressure. If there had been only a few hospitals in India, the scenario would have been as described.

People have additional choices after the establishment of private hospitals. Private hospitals were introduced by the government to lighten its workload, but their costs were exceedingly high. And it was now a major problem for those from the middle class. In order to prevent this, health insurance was created, making it possible for people to pay for better government services if they so choose. But keep in mind that only the government is still responsible. Health insurance was formerly only offered to industry workers. People who used to operate large equipment did so because they lived in high-risk areas, but this was insufficient.

For those businesses with more than 10 employees, it was a requirement. But once this did not succeed, a plan was put up that required both the business and the employee to make financial investments. so that no one person is responsible for everything. Additionally, more people ought to enjoy risk-free lives while the ESI system is still in operation. This programme is available to you if your annual salary is less than 21,000 rupees. The families of Central Government employees received health insurance when the Central Government Health Scheme (CGHS) was launched. The families of employees then began receiving coverage from some MNCs. Now, regardless of whether you work or not, you can purchase individual or family insurance.

Charges of Privates hospitals

We all know that private hospitals charge more for services than do public hospitals. We should also be aware of the exact cost. and we’ll discuss how significant the difference is based on the facts. Therefore, it is 6 times more expensive to be admitted to a private hospital in India than a government hospital. You can find the precise data in the report from the Union Ministry of Statistics. A government hospital admission typically costs 4452 rupees. And it costs Rs. 31,845 to be admitted to a private hospital. Even with such a drastic difference, a common man must visit a private hospital if he becomes ill. It shows that none of the administrations that have served since our independence have done their jobs completely. In order to determine whether or not these bills are real or whether there has been any manipulation, the bills of patients who visited the renowned private hospitals in Delhi NCR were gathered and examined.

Medicine Scam

And the National Pharmaceutical Pricing Authority has carried out this (NPPA). As a result, it was discovered that private hospitals were prescribing non-generic medications instead of generic ones. What exactly are these generic drugs? You need to be aware that the price of generic medications is set by the government. You cannot choose the rate. Therefore, private hospitals prescribe medications from other brands where the commission is already set in order to avoid them. NPPA examined the patients’ bills, Therefore, just 4% of generic medications were prescribed in the patient’s entire medical expense. to increase the margin. Everything else belonged to the private players, who lost it. The pricing was not constrained in any way.

A first invoice for the medication obtained from the distributor in the private hospital. You will be able to comprehend the private hospital’s actual out-of-pocket expenses as well as the patient fee. This syringe was purchased by the private hospital for 68 units at a cost of 1.28 rupees apiece. and the patients were charged 23 rupees. Their profit margin exceeds 1000%. You can also look up other things’ rates. There is a man who earns all the money and has parents, a wife, kids, and siblings. So he can’t go through life believing no one would ever get sick or need to go to a private hospital. Making this kind of judgement is extremely bad.

The cost of living

A middle-class man makes every effort to avoid paying for medical expenses in order to prevent going into poverty. There are therefore two options: either you have enough money to pay for treatment when such an emergency arises, or the only other option is to purchase health insurance. You’ll notice that every citizen of wealthy nations has access to health insurance. There are more than 20 nations with a population that is completely insured. Citizens of nations with subpar healthcare must have health insurance. But in India, people continue to put their future at danger by putting all these things in God’s hands or by acting ignorantly toward them. which is untrue. This issue is becoming more urgent given how quickly inflation is rising. Although there is inflation everywhere, the cost of living has risen due to inflation in the medical industry.

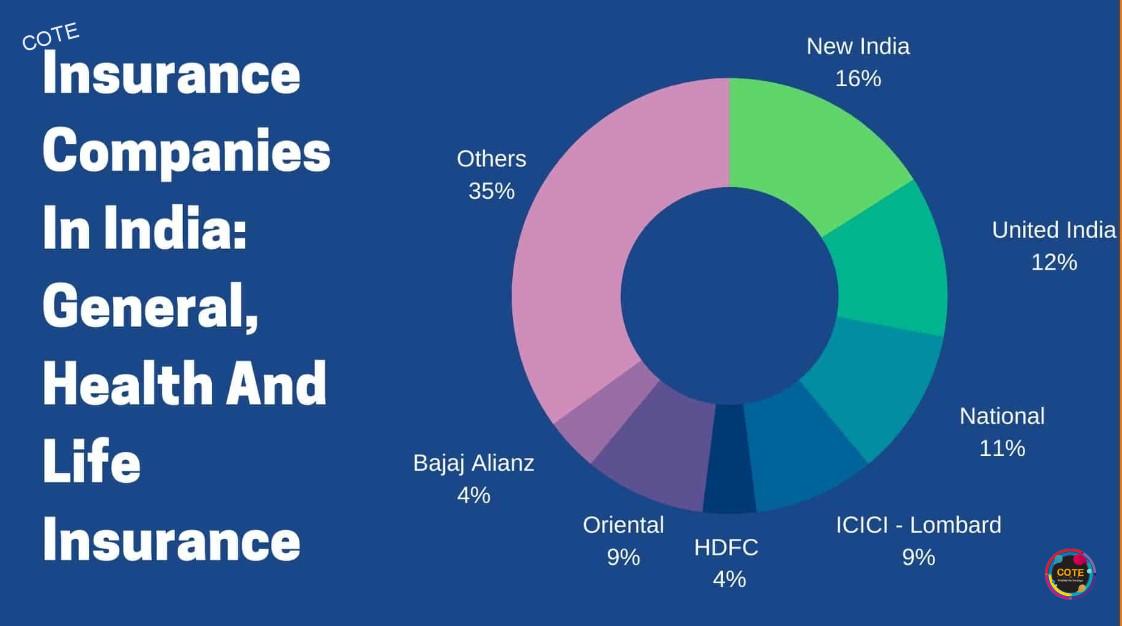

Every year, the price of medical care and prescription drugs rises. Additionally, a major justification for getting health insurance is inflation. There are many different kinds of businesses that provide insurance. However, not everyone qualifies for the same insurance, so you must choose the finest plan for your needs. Who actually needs health insurance, though? If you don’t need it, you shouldn’t be paying a price. Do Elon Musk or Bill Gates have health insurance? Need they have this? You should consider if you can live without the specific product for which you are purchasing insurance before you get it. If you can’t live without losing that specific item, you must purchase insurance. Bill Gates and Elon Musk will insure whatever they can’t afford to lose because they can afford their medical expenditures without health insurance. We also need to take this into account.

Health Insurance

People who work for the government now receive insurance from the federal or state governments. Additionally, the government introduces health insurance for the underprivileged. Higher-ranking employees in the private sector are looked after by their employers. And the wealthy man looks after himself. The middle-class man, however, must have health insurance. For those people still without money or health insurance, Niti Aayog continues to produce reports. These folks were referred to as the missing middle in the October 2021 report. The middle class is most in danger. According to this report, 40 crore people are still at risk since they have not purchased insurance. Let’s now talk about the finest method for obtaining health insurance. What else you should consider while purchasing health insurance.

Therefore, the first thing you must determine when purchasing health insurance is whether it accepts cash. Because if it is not cashless, you will need to make financial arrangements and afterwards receive payment from the business. Going cashless is a better option because it requires less paperwork and only requires you to check the network hospitals of the firm in question. whether the region in which you live has a hospital run by that specific insurance carrier. In an emergency, you should travel to the hospital for care, and the insurance provider will cover the costs. The second thing you must verify is whether pre- and post-hospitalization coverage is included in your insurance. You have since received your therapy and deposited the insurance company’s payment.

Cost of Insurance

However, there are significant costs both before and after the procedure. You must also check for various tests, doctor’s office fees, physiotherapy recommendations in specific circumstances, ambulance costs, etc. You must also confirm whether the co-pay option is available through your insurance. Consider a scenario in which your hospital bill came to Rs. 1 lakh and your insurance has a 5% co-pay provision. Therefore, you will need to pay 5000 rupees in that situation. Before purchasing insurance, you must also verify the coverage cap. If any restrictions have been placed on a specific course of therapy Let’s say you need knee surgery, and the insurance you purchased has an 80,000 rupee cap on the cost of the procedure. In that scenario, you would be responsible for paying any costs that exceed Rs. 80000. Cap denotes the establishment of a limit.

Additionally, anytime you compare policies, take note of the no claim bonus. Some insurance companies will reward you if you don’t make a claim within a certain year. You should also check these things because some providers might enhance the amount of coverage you have, offer free health exams, or reduce premiums. Choosing the least expensive health insurance on the market won’t address all of your difficulties. To ensure that you will receive an insurance claim when you need it, you must research the insurance company’s reputation and claim settlement rate. rather than experiencing any kind of application rejection. The number of insurance claims filed and those that were denied by the company is indicated by the claim settlement ratio. You must obtain a policy in accordance with your pre-existing medical condition. Never conceal a pre-existing condition; doing so invalidates your insurance.

Premiums

They will eventually learn about it, and if you try to hide it, you risk losing your premium and having your policy cancelled. A sickness is deemed pre-existing if it was present for at least 48 months prior to the date you signed up for insurance. The second thing you need to check is whether the insurance you purchased has any room rent capping provisions. and what is the cost? Assume you have been admitted to the hospital. Since hospitals offer a variety of room types, including deluxe and luxury rooms, you may occasionally get to pick your room.

Additionally, there are times when you are forced to book a premium suite because the other rooms are not available. Or perhaps the hospital is a luxury. Let’s say you booked a luxurious room for 10,000 per day. There is no issue if your insurance is cap-free, meaning there is no restriction and you can book any accommodation, but if your insurance has a cap, there is a limit put in it. Consequently, you won’t receive the whole amount due for your hotel rental. Now, you’ll ask, “If not the entire sum, then how much?” According to the insurance provider, you must purchase a more expensive coverage if you want a good accommodation that is worth more money. You can receive up to 5,000 rupees in rent if your insurance policy covers 5 lakh rupees. Typically, 1% of the entire policy is offered.

Hospital bills without Insurance

If a hospital bill is 3 lakh rupees and the insurance company is paying 5000 for room rent, you may now believe that there is no issue. Even if it costs a bit more, you will pay for it out of your own wallet, so what’s the issue? That won’t be how it works. Some insurance providers tie your full insurance to your room fee, so if you booked a room for 10,000 rupees but your insurance only covers 5000, your room rent will be 5,000 rupees. Therefore, the insurance provider is covering 50% of your room rental. The remaining amount is your responsibility to pay. The insurance company will only cover 50% of the entire hospital expense, including medicine and full treatment, when you combine it with room rent. In order to ensure that your insurance policy is independent of your room rent, you must also double-check it. There are often two plans available when you get insurance. Both the Individual Plan and the Family Floater Plan are available.

| Social Media Links:- | #CONTENTONTHEEDGE – C.O.T.E |

| Youtube- ✅ | Subscribe to the YouTube channel of Content on the Edge |

| Facebook- ✅ | Like and Follow on Facebook for Latest content videos of C.O.T.E |

| Instagram- ✅ | Follow on Instagram for Latest content |

| Twitter- ✅ | Join Content on the Edge on Twitter for latest updates |

| Telegram Channel- ✅ | Join Telegram Channel to get latest files and updates |

| Telegram Group- ✅ | Join C.O.T.E Telegram Group to get latest updates |

| Whatsapp- ✅ | Click to text C.O.T.E on Whatsapp |

| Whatsapp Channel- ✅ | Click to Join C.O.T.E Whatsapp Channel for Latest Updates |

Individual plan:

You can customise your plan to meet your needs. A family floater plan provides insurance for every member of your family. For instance, if you purchased a family floater insurance policy for 5 lakh rupees, you can now use that amount if any member of your family falls ill. However, there is an issue in that the insurance company will not pay out more money if someone else gets sick as well. You will now claim that this plan is the finest and that you should implement it because no one in the family will get sick at the same time.

Insurance Providers

Insurance providers are not here to help. This family floater policy is created based on age. If you have family members who are older than you are, your premium will be more than the average person’s. For this reason, you should never include senior citizens in a family floater plan. Take out individual insurance for each of them; it will be more cost-effective. The final query is how much health insurance is recommended. You see, there are a lot of variables here, like your age, whether your family has a medical history, whether you have any pre-existing conditions, and how you live in general. As a result, you ought to purchase insurance. However, it is generally accepted that if you are younger than 30, you should at the very least purchase coverage of 3 lakh.

Additionally, you must get a family floater with a minimum cover of 5 lakh. By the way, since the cost is higher in metro areas, you should take more than you would in those areas. Additionally, some experts advise that it be set at 50% of your yearly salary. Or it ought to correspond to the volume of heart surgery performed in local hospitals. When you get health insurance, you also receive tax benefits. Section 80D offers a tax advantage of 25,000 rupees.

Watch Video below by Think School

After reading this article about Insurance, now i am also thinking of getting health insurance for my Parents. Thanku for this useful information on insurance

Bahut hi acha content hai about Insurance. Keep providing us with these useful insights on various topics. thank you so much