12 important variables that will keep traders busy next week on Dalal Street

The onset of the earnings season will make this coming week exciting. The market is anticipated to be volatile because participants will also be paying attention to macroeconomic data and US inflation rates, according to experts.

Positive global indications helped the market conclude the holiday-shortened week more than 1% higher, marking the first such advances in the previous four weeks. All but the FMCG industry took part in the build-up.

The start of the earning season is expected to make for a hectic next week. The market will probably be turbulent because participants will also be monitoring macroeconomic data and US inflation figures, according to experts.

The Sensex increased by 764 points to 58,191 during the week that ended on October 7, while the Nifty increased by 220 points to 17,315. The Nifty midcap 100 index and smallcap 100 index both increased by 2.4 percent and 2.6 percent, respectively, showing that the overall market beat the benchmark.

“The recent bounce has been sparked by the improvement in global indexes, particularly the US, but the lack of sustainability in the advance is resulting in extreme volatility. However, we believe that local factors like earnings and macroeconomic data could take the lead and determine the direction of future trends “Religare Broking Vice President of Research Ajit Mishra said.

The focus should be on the top-performing shares, which should be accumulated on dips, the market expert added, since all sectors are experiencing traction on a rotational basis.

The following 12 important factors will keep traders busy the following week:

1) Business profits

IT giants (Tata Consultancy Services, Infosys, Wipro, and HCL Technologies) as well as other Nifty50 firms like Bajaj Auto, Shree Cement, and HDFC Bank will start the September quarter results season. These companies account for almost 23% of the total weight in the NSE benchmark index.

Additionally releasing their quarterly results are Mindtree, Larsen & Toubro Infotech, Avenue Supermarts, Delta Corp, Angel One, Cyient, Federal Bank, Oberoi Realty, Tata Elxsi, and ICICI Prudential Life Insurance Company.

So, stock-specific movement will be observed the next week.

“Stock-specific fluctuations will be visible,” said Apurva Sheth, Head of Market Perspectives at Samco Securities. “When investors respond to earnings misses and beats, they should consider the company’s long-term prospects rather than concentrating entirely on quarterly results.”

2) CPI Inflation

The CPI inflation figures for September, which will be reported on October 12, are another important aspect to keep an eye on domestically. The same day will also see the release of the August industrial output statistics, while October 14 will see the release of the WPI inflation data.

The majority of analysts predict that inflation, which is a major factor in the Reserve Bank of India’s rate choices, would continue to be higher than the target rate of 4 percent (+/- 2 percent), or over 7 percent.

Rahul Bajoria, MD & Head of EM Asia (ex-China) Economics at Barclays, stated that “we estimate headline CPI inflation rose higher to 7.30 percent YoY in September, as a sequential rise in food prices, together with sticky core CPI, kept inflation elevated.”

While this suggests nine consecutive months of inflation above the target band, Barclays anticipates a substantial decline in inflation in October due to a mix of high base effects, falling import costs, and some sequential reversal in food prices. In August, inflation reached 7 percent.

While Chinese and American inflation rates will be closely watched by international investors, the Indian CPI print will be a crucial domestic element to keep an eye on.

On October 14, in addition to macrodata, the balance of trade for September, foreign exchange reserves (for the week ended October 7), and minutes from the most recent monetary policy meeting will all be made public.

3) US inflation and FOMC minutes

Global market investors will be closely following the release of the FOMC minutes on October 12 and the US inflation data the following day.

After the US manufacturing PMI fell this week, there were hopes that the Federal Reserve might ease off on its policy tightening, but the central bank’s policymakers have continued to express hawkish views.

Expectations that the Fed may continue its aggressive policy tightening to get inflation at the 2 percent objective increased in response to the most recent jobs data, which was basically in line with street projections and showed a declining jobless rate.

The majority of economists anticipate US inflation in September to be higher than 8 percent compared to 8.3 percent in August.

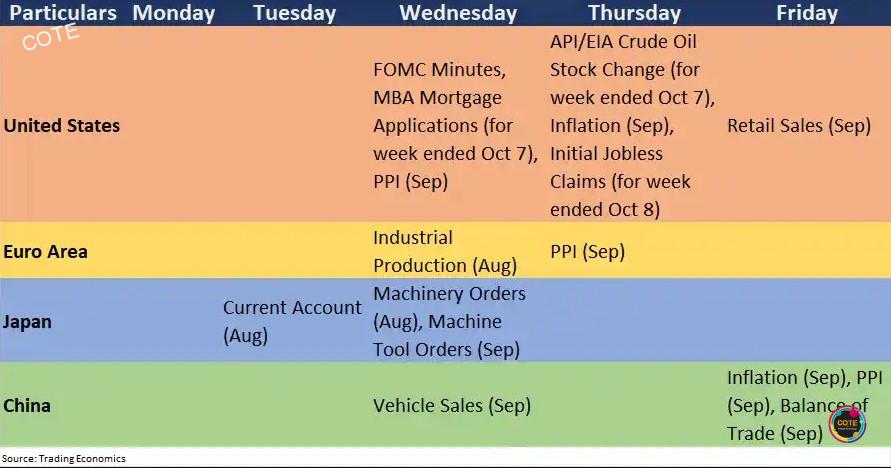

4) Additional world data

Important worldwide data to keep an eye in the coming week are listed below:

5) Oil prices and the rupee

The Street will also be paying particular attention to currency and oil price movements after a sudden change in both. The Indian rupee lost more ground against the US dollar and for the first time ever closed below 82. The dollar is strengthening as concerns grow that the Federal Reserve will maintain its aggressive policy tightening to control inflation in the coming policy meetings. The unemployment rate and most recent employment statistics show the same pattern.

On October 7, the rupee lost 44 paise and lost almost 100 paise during the course of the week, closing at 82.33 to the dollar. Its intraday low of 82.4275 to a dollar was a historical low.

The World Bank’s revision of India’s GDP forecast from 7.5 percent to 6.5 percent, citing a deteriorating global economy and rising oil prices, added to the pressure on the rupee.

On account of risk aversion on the international market and the general strength of the dollar, Anuj Choudhary, research analyst at Sharekhan by BNP Paribas, anticipates that the rupee will trade with a negative bias in the range of 81.50-83. Foreign investment inflows could sustain the rupee at lower levels, though.

According to the analyst, markets could also be influenced by US non-farm payroll data, which is forecast to show job growth but at a slower rate than in the previous month.

The dollar index, which gauges the value of the dollar against a basket of the six most valuable currencies in the world, remained high as it corrected up to 110.06 during the week on expectations that the Fed would hold off on tightening monetary policy in response to a disappointing manufacturing PMI reading.

However, the unemployment rate and employment figures increased the likelihood of a drastic tightening of policy, which sent the DXY higher to conclude the week at 112.75. The 3.89 percent increase in US bond yields helped the dollar gain ground.

After OPEC+ resolved to reduce output by 2 million barrels per day, crude oil prices began to inch closer to $100 per barrel once more as concerns about a recession in western countries have grown along with rising interest rates.

An unfavourable price for oil-importing nations like India, benchmark Brent crude futures completed the week at $97.92 per barrel, up about $10 per barrel.

6) Flow of FII

After the US dollar’s continuous rise, foreign institutional investors (FII) were marginal sellers. According to experts, the market is projected to remain unpredictable over the next few days as a result of the inconsistent FPI activity.

“Early in October, FPIs switched to being marginal purchasers, although their behaviour has been inconsistent. Only when the dollar reaches its high and exhibits a persistent downward trend will FPIs become sustained buyers “Geojit Financial Services’ Chief Investment Strategist, VK Vijayakumar, said.

FIIs sold shares for a net total of Rs. 36.55 crore in October, compared to sales of more over Rs. 18,000 crore in September. Domestic institutional investors (DIIs), who have absorbed the impact of FII selling, have continued to be net purchasers, adding more than Rs 1,000 crore in purchases so far in October to the more than Rs 14,000 crore they made in purchases during the previous month.

7) IPO

Throughout the week, the major market will be open for business. On October 10, Tracxn Technologies, a provider of market intelligence data, will begin accepting subscriptions for its Rs 309 crore public offering at a price range of Rs 75-80 per share. The bid, which is a purchase bid, expires on October 12.

In addition, the fourth-largest consumer goods and electronics store, Electronics Mart India, would complete the share distribution for its initial public offering by October 12 and credit shares to the demat accounts of qualified investors by October 14.

8) Technical

The Nifty formed a small-bodied bullish candle on the daily charts on October 7 and a bullish candlestick on the weekly scale, which helped it hang onto the psychologically significant 17,000 mark throughout the month of October. According to experts, the level will serve as a significant support and, if held, can lead the Nifty towards 17,500–18,000 in the upcoming days, though volatility cannot be completely ruled out. According to them, the next important support level, which if broken, can trigger a strong decline, is between 16,750 and 16,800.

“It appears that the bulls are finally making a comeback after taking a significant beating from 18,100 levels a few weeks ago. Before trying a retest at 18,100 in November, the bulls are anticipated to hold at 17,000 for the entire month of October “Samco Securities’ Apurva Sheth, Head of Market Perspectives, stated.

She stated that 17,500 is the area of immediate resistance.

9) F&O signals

The Nifty is anticipated to remain in the 17,000–17,500 region in the upcoming days, which can serve as the market’s most important support and resistance, respectively. Call writing occurred at 18,000 strike and then 17,500 strike, with 18,000 strike seeing the highest Call open interest.

10) With Put writing at 17,000 strike and subsequently 16,500 strike, the maximum open interest for Puts was observed.

“Put writing was observed on weekly expiry at levels of 17,000 and 16,500, adding more than 80,000 contracts each level, which is the support amassed for the index. The 17,500 and 18,000 strikes with over a lakh contracts each represent the call writers’ exposure, and these will be the main resistance zones moving forward “Shilpa Rout, a lead analyst for derivatives at Prabhudas Lilladher, stated.

11) According to her, the 17,300 individual strike PCR-OI (Put Call Ratio open interest) is only 1, which needs to be decisively above 1.5 and hold for a strong upmove to come. However, the Nifty overall PCR-OI is currently 0.97, which also indicates that some exhaustion and consolidation are taking place and will likely continue for some time.

The India VIX volatility index decreased by almost 6% over the course of the week to 18.81 levels, but it still needs to decline further and continue to be below the 18 level in order to provide market stability.

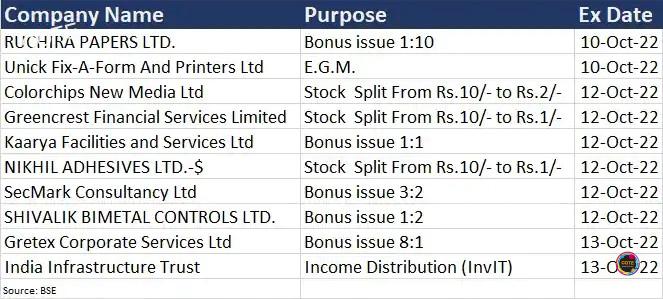

12) Business action

Next week will see the start of the ex-bonus trading period for Ruchira Papers, Kaarya Facilities and Services, SecMark Consultancy, Shivalik Bimetal Controls, and Gretex Corporate Services. The ex-split trading period will begin for Colorchips New Media, Greencrest Financial Services, and Nikhil Adhesives shares.

The following are significant business events coming up in the upcoming week:

Disclaimer: The opinions and investment advice provided by industry professionals on Contentontheedge.com are their own and do not represent the position of the website or its administration. Before making any investment decisions, Contentontheedge.com recommends users to seek the advice of qualified professionals.