Shareholders of Ambuja Cements approve a preferential offer of warrants worth more than $20 billion or 20k crore

The issuance of equity shares totaling more than 20,000 crore to Harmonia Trade and Investment on a preferential basis has been approved by Ambuja Cements’ shareholders. During the extraordinary general meeting (EGM) that took place on Saturday, the matter was approved. Karan Adani, the son of Gautam Adani, presided over the gathering.

During the meeting, the preferential issue received 91.37% of the votes, while the resolution received 8.63% of the votes against it.

The board of directors of Ambuja Cements authorised the issuing of 477,478,249 warrants to Harmonia on a preferential basis, with each warrant having a face value of 2 and being convertible into or exchangeable for 1 fully paid-up equity share of the firm.

This preferential offering’s fixed issue price is 418.87 per warrant.

According to the regulatory filing, each warrant will be convertible into or exchanged for 1 fully paid-up equity share of Ambuja Cements in cash, up to a total of 20,001 crore, and it can be exercised in one or more tranches between the date of the warrants’ allocation and the end of the 18-month period.

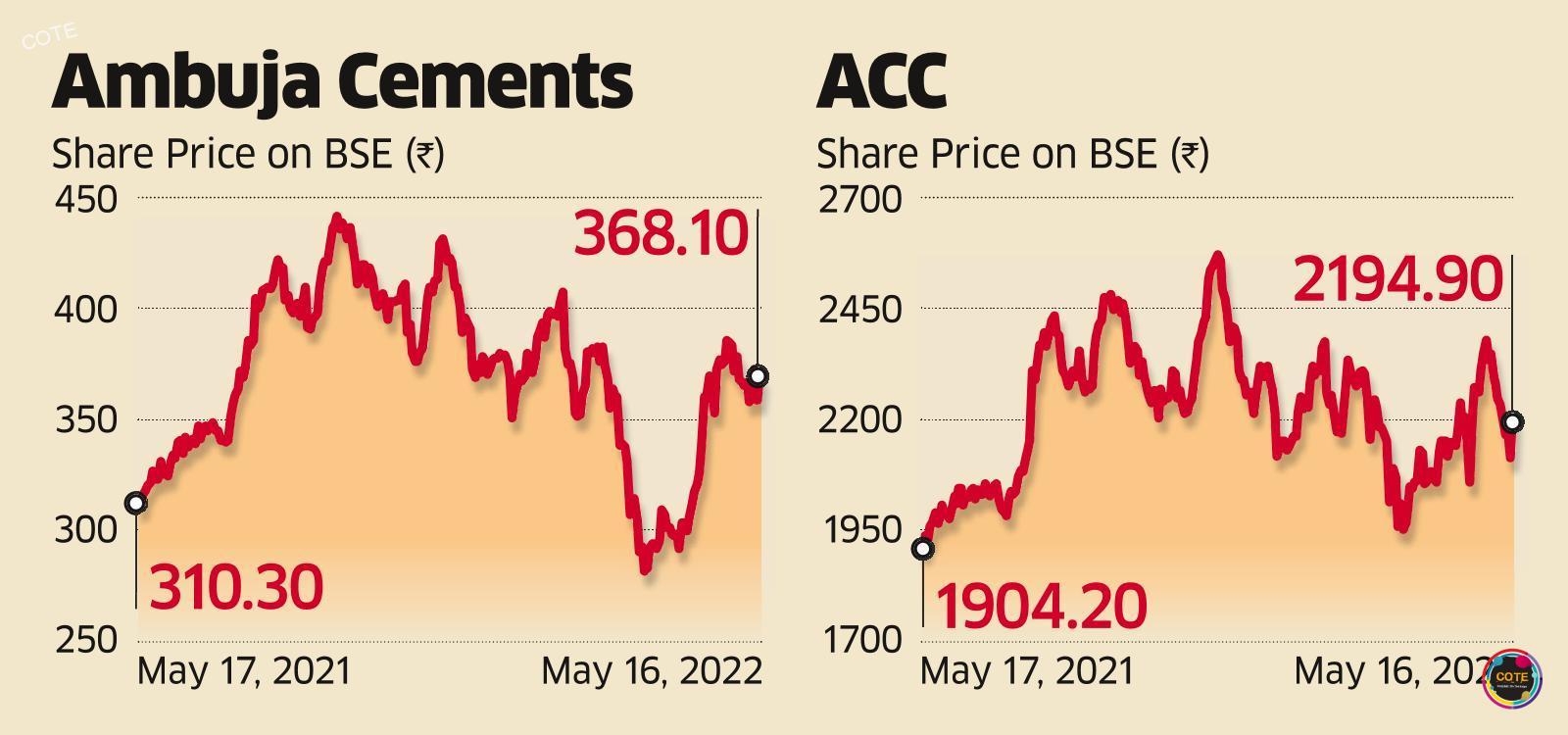

Earlier, in September, Ambuja Cements and ACC, two significant Indian cement manufacturers, were fully acquired by Gautam Adani’s Group. The Group is presently the nation’s second-largest cement supplier. By selling all of its shares of ACC and Ambuja Cements to the Adani Group for 2,300 rupees a share and 385 rupees each, respectively, Holcim completed the transaction with the latter on Friday. For Holcim, the total cash proceeds came to 6.4 billion dollars.